Do you need to pay tax on your income from OnlyFans?

In most cases, yes.

Your earnings on OnlyFans are taxable under income tax and self-employment tax. This includes money you earn through subscriptions, tips, donations, PPV (pay-per-view) content, and other income avenues the platform provides.

Your OnlyFans income is subject to income tax the same way a regular 9-5 is. The more you make, the more you pay. In addition to income tax, you also have to pay self-employment tax. The latter is a fixed percentage of your earnings.

There is a certain threshold of income you need to meet before having to pay taxes. This amount varies based mainly on your country of residence.

In many countries, even if you don't make enough to have to pay, you still have to report the amount you earned.

Sounds troublesome, I know. This article will give you a much clearer understanding of your tax duties and how you can fulfill them.

What is Self-employment tax?

The main idea to grasp before filing OnlyFans taxes as a creator is that you're not an employee of the platform.

You're running your own small business, and you're the sole proprietor. Your relationship with OnlyFans is that of an independent contractor.

You're considered self-employed by the law. Therefore, you are required to file self-employment tax in addition to income tax.

In the U.S., self-employment tax consists of Social Security tax (12.4%) and medicare tax (2.9%), totaling 15.3%. It's equal to the FICA tax deducted from the salary slips of salaried individuals.

Self-employment tax is how business owners and independent contractors pay FICA tax.

What forms do you need to be familiar with?

Here are the tax forms you'll come across while filing your OnlyFans taxes in order:

W-9 - Request for Taxpayer Identification Number and Certification

The IRS requires OnlyFans to have your tax information on record.

OnlyFans does not automatically take out taxes from your income. They send you the total amount you earn (after taking their 20% cut).

They need your tax info so they can tell the IRS you'll be paying taxes for the money they send your way.

When you try to withdraw your earnings for the first time on OnlyFans, you'll be prompted to fill out a w9 form.

Taxes on OnlyFans - the OnlyFans W9 tax form

How to fill out W9 for OnlyFans

The form may look intimidating, especially if it's your first time dealing with taxes. Here are some step-by-step instructions to help you fill it out.

Line 1: Your full name.

Line 2: You can leave this empty unless you have a DBA "doing business as" name or an LLC.

Line 3: Check the first box, "Individual/sole proprietor or single-member LLC."

Line 4: Leave this blank.

Line 5 and 6: Your mailing address.

Line 7: Leave this blank.

Part 1: Enter your SSN (social security number).

Part 2: Add your sign and date to the form.

Only once you fill out the OnlyFans W9 form you are allowed to withdraw your earnings.

If you're from outside the U.S., you'll have to fill out a w8-BEN form instead.

This form essentially certifies that you are not a U.S. resident and therefore don't have to pay taxes to the IRS.

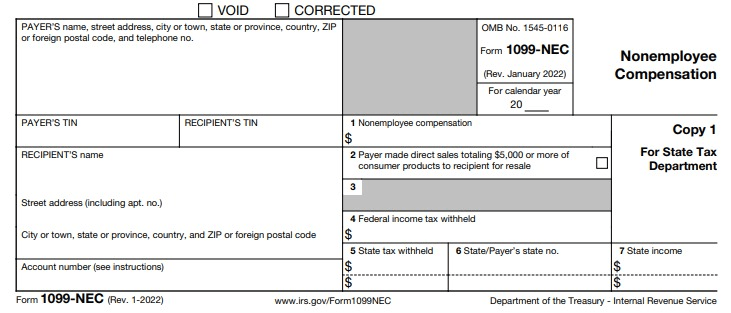

1099 NEC - Nonemployee Compensation

Unlike the W-9, the 1099 NEC is not a form you must fill out. It's simply a document that OnlyFans will mail to you at the address you mention in your W-9.

The OnlyFans 1099 helps you figure out your gross business income.

The Onlyfans 1099 form tells you exactly how much money you made on the platform over the entire year. This amount is your gross business income.

OnlyFans will send you a 1099 NEC only if you make more than $600 over the year and are a U.S. resident.

If you make less than $600, OnlyFans won't send you a 1099 form. However, you still have to report whatever amount you made to the IRS on your annual income tax return.

If you aren't a U.S. resident, you won't be sent an OnlyFans 1099 form. It's all the more critical for you to store your documents, bills, and receipts. Having your files in order will save you many headaches when it's time to pay.

Lastly, when does OnlyFans send out tax forms?

If you're eligible for a 1099 NEC, you should receive one in your mail by January 31st. You will also be able to access a digital version of the form on OnlyFans.

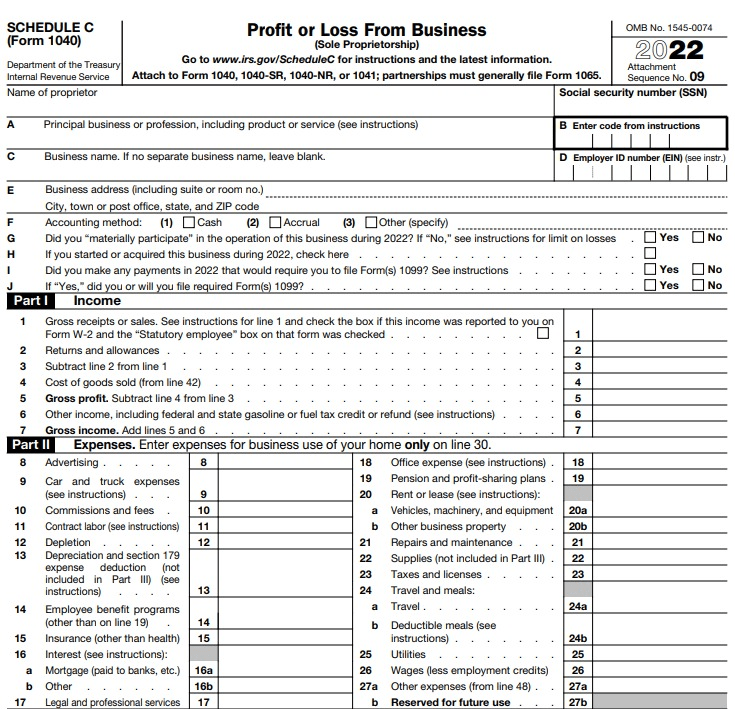

1040 Schedule C

Since you're a small business owner, you need to file a Schedule C in addition to your standard 1040 tax return.

Schedule C - OnlyFans taxes only apply to your net income after business expenses.

You will note the gross business income (stated on your 1099) and any business expenses on this form.

The remaining amount is your net income - in other words, how much profit you made. This is the amount you'll have to pay income tax and self-employment tax on.

In a minute, I'll cover the various Onlyfans tax write offs you should avail of to avoid paying more than you must.

1040 Schedule SE

When you're done figuring out your net income on your Schedule C, you will fill out Schedule SE.

Schedule SE is where you'll calculate the self-employment tax you owe based on your net income.

What tax write-offs can you avail as an OnlyFans creator?

Now, for the part you've probably been waiting for, tax write-offs. The more you can write off as a business expense, the less total tax you'll have to pay.

But - before we proceed, there's something important to note.

Onlyfans tax write offs are only available to business owners, not hobbyists. The distinction between a business and a hobby can be somewhat subjective.

Some official guidelines exist to help you figure out where you stand.

The IRS won't consider you a business owner if you aren't trying to profit from your activities on OnlyFans.

This IRS-published article goes into more detail.

Note that earning from OnlyFans as a hobby doesn't exempt you from paying taxes entirely. You won't have to pay self-employment tax but will still pay income tax.

Back to the topic: What business expenses can you potentially write off?

Equipment purchased or rented for shooting, recording, filming, editing, and processing (Cameras, smartphones, computers, sound equipment, props, etc.). These are all items essential to create good content for your OnlyFans business.

WiFi and data usage. Since your OnlyFans business is entirely online, you need to use the internet to operate it. Let's say you spend 30% of your airtime working on your OnlyFans. You'll be able to write off 30% of your internet bills as a business expense.

Travel costs. Traveling to close a high-value business opportunity, for example. Or to shoot content at a particular location requested by a high-paying client. In both cases, you could write off your incurred fuel costs as a business expense.

OnlyFans' platform and transaction fees. This one's a no-brainer; you can easily consider this an OnlyFans tax write off.

Clothing. More specifically, custom clothing you need to purchase to satisfy subscriber requests. By contrast, you won't be able to write off the casual clothing you purchase for everyday wear.

Costumes for cosplays, if it's something you showcase on your OnlyFans.

Tools that help you attract subscribers. Social Rise is one such example. There’s no way around promotion. You can’t grow without it, and the more you promote, the higher payoff you see. Sadly, it’s also the most exhausting part:

You stress about posts all the time.

Missed days cause dips in earnings.

Your promo folder is a mess.

Posts flop and make you anxious.

You waste hours on social media every day.

It can suck the soul out of you! But it doesn’t have to be that way with Social Rise. Try it if any of this sounds familiar. It makes promotion easy and effective, so you can focus on your paid page. And since you can write it off, it's practically "free".

Hate Promoting OnlyFans?

You’ll Love This.Generate and schedule weekly posts for all your socials in minutes—automatically sent out at the best times. Track what works, stay organized, and promote less for more money.

Try For FreeNo credit card needed.

Rent. If you're renting out a place to shoot your OnlyFans content, you may be able to write off a portion of the rent.

Make-up and beauty supplies you use exclusively for your OnlyFans content. This makeup has to be separate from your regular makeup stash.

Commissions and wages. You may hire a professional photographer or video editor to create better content. You can write off their wages as a business expense if you do.

You get the gist of it. If it's an expense you bear purely to benefit your business's current operation or future growth - and it serves little to no benefit to you in your personal life - you will likely be able to write it off.

For an expense to be deductible, it must be both ordinary in your line of work and necessary for your business. The IRS has some pretty comprehensive guidelines on what will and won't fly.

You should go through this document before filing your Schedule C. It will help you better understand the write-offs available to you.

It helps to keep your OnlyFans-related bills and receipts handy, electronically or physically, so your write-offs are backed up by hard evidence.

It's unlikely to happen, but the IRS could ask about your expenses' legitimacy.

It's also a good idea to open a separate bank account for your OnlyFans-related income and expenses.

That way, the difference between your bank balance and gross income will represent your business expenses.

Remember that this assumes no deposits or withdrawals unrelated to OnlyFans are made.

When do I have to pay my Onlyfans taxes?

In the U.S., you must pay OnlyFans taxes quarterly (four times per year) if you expect to pay more than $1000 in tax over the year. This is an estimated tax.

If you wait to pay annually, you'll have to pay interest for not paying on time. You could be subject to additional monetary penalties on top.

Having to pay four times instead of one can be a bit of a nuisance. But, on the bright side, paying in four smaller deposits is relatively manageable. Producing one massive sum of money at the end of the year - not so much.

Also, since you'll be estimating how much you owe, the IRS gives you a 10% margin of error. So you won't be in trouble if you're off slightly.

The four deadlines for quarterly payments are:

April 15th

June 15th

September 15th

January 15th (next year)

To determine your estimated tax, you'll have to use Form 1040 ES.

To pay, mail the form with a cheque for the amount you owe to your designated mailing address.

Alternatively, you can pay online.

FAQs about OnlyFans taxes

Do I need to fill out an OnlyFans W2 form?

Unless you're an employee working for OnlyFans, you do not get a W-2 from them. As a content creator on the platform, you must fill out a W-9 OnlyFans tax form before withdrawing any of your earnings.

How much taxes do you pay on OnlyFans?

Your earnings on OnlyFans are taxable under income tax and self-employment tax.

In the U.S., self-employment tax consists of Social Security tax (12.4%) and medicare tax (2.9%), totaling 15.3%. And your income tax differs depending on the amount you earn.

What does OnlyFans tax form look like?

The tax form OnlyFans sends you is a regular 1099 NEC (Nonemployee Compensation) form. You can find a copy of it and all other forms you have to fill in this article or on the IRS website.

Does OnlyFans take out taxes from my earnings?

If you've worked a 9-5 before, you may be used to having your taxes deducted from your salary automatically.

However, you need to understand here that OnlyFans is not your employer. They cannot withhold taxes from your earnings.

You're an independent contractor - a (small) business working with a (much larger) company. OnlyFans will send you the total amount you earn after taking their 20% cut. You'll have to pay taxes on your 80% yourself.

Will OnlyFans show up on my taxes?

OnlyFans will send you a 1099 NEC if you earn more than $600 in the year. Fortunately, the document will be sent by "Fenix International Limited." This is the parent company behind OnlyFans.

So it won't be apparent immediately, but it doesn't take much to connect the dots.

If someone else does your taxes for you, and you're worried they might catch on, now is the best time to start doing them yourself.

Conclusion: How to file taxes for OnlyFans

There are many jobs you have to do as a creator on OnlyFans, and taxes are one you definitely can't skip. If you decide to do it yourself, you now have a pretty good idea of how to do taxes for OnlyFans. To sum everything up:

You are the sole proprietor of your own business. You're self-employed.

Your OnlyFans income is subject to income tax and self-employment tax.

You will need to fill out the OnlyFans W9 form before you can withdraw earnings.

You will receive an Onlyfans 1099 form in January via mail and a digital version on the platform.

You will file a Schedule C and a Schedule SE with your 1040 income tax return.

You can write off business-related expenses to reduce your taxable income.

You should pay quarterly if you expect to owe over $1000 in OnlyFans taxes.